Kotak Mahindra Bank Credit Card Review: Documents Required, Types, Rewards

Kotak Mahindra Bank Credit Card Review | Introduction

When you talk about banks and credit card there is no reason to take a call on Kotak Mahindra Bank and its credit card services. They have been tremendously growing in the market for their excellent service options in terms of credit cards which you can plan to get according to budget and of course the services with each one you go for.

We will discuss later in the article about the documents requirement, eligibility facilities attached to each credit card and customer care support system as well. Let’s read the review of Kotak Mahindra Bank Credit Cards and services offered by each one.

Eligibility & Documents Required for Kotak Mahindra Credit Card

Those who are interested in applying for kook Mahindra bank credit cards they must fulfil these criteria to get their need of getting a credit card to be fulfilled. You should take care of the following:

- Credit score

- Age-should be between the bracket of 21 to 65v years old

- Monthly income-should have a constant and steady source of income

- Location-some cards are designed for specific residents in the cities of India like Delhi, Gurgaon, Noida, Ahmedabad, Hyderabad Kolkata, etc.

- Documents required

Identity Proof

- PAN Card

- Aadhaar Card

- Voter’s ID Card

- Passport

- Driving Licence

- Any other government-approved photo ID

Address proof

- Aadhaar Card

- Passport

- Utility bills (not more than 3 months old)

- Any other government-approved ID

Income Proof

- Bank statement of last 3 months

- Salary slips of 3 months

- Audited financials for the last two years (for self-employed)

- Form 16

Types of Credit Cards Kotak Mahindra Bank Offer–

Kotak Delight Platinum Premium Card

Key Features:

- Film and Dining Discounts – 10% Cashback on all of your Dining and Movie spends

- CashBack Benefits – Maximum cashback of Rs.600 per billing cycle

- Movie Benefits – Spend Rs.1,25,000 at regular intervals of 6 months and get 4 free PVR tickets

- Convenience Fee Waiver – 1.8% railway surcharge waiver for transactions on www.irctc.co.in

Royal Signature Credit Card

Key Features:

- Lounge Access – Get 2 free Visa Lounge Visits per quarter.

- Rewards – Earn up to 4X reward points on travel costs like hotels, restaurants, international spending, etc. Get reward points against air tickets, mobile recharge, products and many more.

- Fraudulent Coverage – Get insurance coverage of Rs. 2.50 Lakh against fraud credit card utilization. this is given up to 7 days before the date of reporting.

- Waiver – Get fuel and rail surcharge waiver of 1% and 1.80% individually.

Kotak Essentia Platinum Premium Card

Key Features:

- Saving funds – Get 10% saving funds, up to Rs. 500, on departmental and market, spends. Additionally, gain 1 Saving Point for every Rs. 250 spent on different classifications.

- Film Benefits – Get 1,200 reward points/6 free PVR film tickets on spending Rs.1.25 lakh at regular intervals of every 6 months.

- Reward Points – Redeem your reward points against cash, merchandise, air tickets, air miles, film tickets, and so forth.

Kotak League Platinum Credit Card

Key Features:

Rewards: Earn up to 8X reward points for each Rs. 150 spent in any class. If you don’t mind note that 8X prizes will be relevant simply after you arrive at yearly spends of Rs. 2 Lakh on the card. Before that, just the spends on the following classifications will get 8X rewards and the rest will get 4X rewards:

- Travel Agencies and Tour Operators

- package Tour Operators

- Airlines and Air Carriers

- durable Goods

- Departmental Stores

Films Offer: Earn 10,000 reward points or 4 free PVR tickets on spending Rs. 1.25 lakh or more at regular intervals of 6 months

Fraudulent Coverage: Get a cover of Rs. 1.25 lakh against fraud use. It is provided up to seven days before reporting.

Surcharge Waiver – Get Fuel and Rail (just on IRCTC site) surcharge waiver.

Kotak Urbane Gold Credit Card

Key Features:

- Rewards – Get 3 Reward Points for each Rs. 100 spent.

- Milestone Benefit – Spend Rs. 1.00 Lakh and benefit 10,000 Bonus Reward Points or 4 free PVR film tickets.

- Fraudulent Coverage – Get coverage of up to Rs. 50,000 against unapproved use made on the credit card. It covers all transactions completed 7 days before its reported.

Kotak Solaris Platinum Credit Card

Key Features:

- Rewards – Earn 5X Reward Points for each Rs. 150 spent online. 2X reward points are earned on different transactions.

- Welcome Offer – Earn 2,500 reward points after paying joining charge and making a purchase through the Visa within 60 days.

- Annual Fee Waiver – It can be benefited by spending Rs. 75,000 out of a year.

- Fraudulent Coverage – Available coverage of Rs. 1.25 lakh against unapproved transactions. Applicable up to 7 days before the days of reporting.

Kotak PVR Gold Credit Card

Key Features:

- Shopping Benefits – Complimentary PVR film tickets round the year for shopping transactions.

- Film Benefits – 1 free PVR film ticket* consistently on spending Rs. 10,000 or more in a month to month billing cycle.

- Card Coverage – Coverage of Rs. 50,000 for card assurance against unapproved transactions.

Kotak PVR Platinum Credit Card

Key Features:

- Shopping Benefits – Shop anyplace in India to get complimentary PVR film tickets.

- Film Benefits – 2 free PVR film tickets* consistently on spends of Rs. 10,000 or more.

- Insurance Cover – Free insurance cover worth Rs. 75,000 every year for lost or stolen cards.

Customer Care Service

Kotak Bank credit cardholders can contact the Kotak Bank Credit card client care for any uncertain inquiry using call, email and SMS. Here are the subtleties:

Kotak credit card client care number: 1860 266 2666 (nearby call rates applied)

Kotak Credit card client care Email ID: Kotak credit card holders can submit their complaints or questions through a complaint form given on Kotak official site. Clients need to mention their enrolled email ID.

Kotak credit card client care SMS: SMS to 9971056767 or 5676788 for knowing your Visa balance, due amount, last payment, and so on.

Conclusion

Kotak Mahindra bank is a better option to choose for credit cards when it comes to a customized choice and better to go with for longer and better features. The best coverage protection reward points surcharge on fuels are some of the best things to consider on. Not only this coverage unto 7 days before the fraud is being reported is an uncommon service found in Kotak Mahendra bank that gives a relaxed lifestyle with happy swiping when you have a Kotak Mahendra bank credit card with you.

ICICI Bank Credit Card Review: Documents Required, Types, Rewards

ICICI Bank Credit Card Review: Documents Required, Types, Rewards  IDBI Credit Card Review: Documents Required, Types, Rewards

IDBI Credit Card Review: Documents Required, Types, Rewards  Axis Bank Credit Card Review: Documents Required, Types, Rewards

Axis Bank Credit Card Review: Documents Required, Types, Rewards  Union Bank Credit Card Review: Documents Required, Types, Rewards

Union Bank Credit Card Review: Documents Required, Types, Rewards  RBL Credit Credit Card Review: Documents Required, Types, Rewards

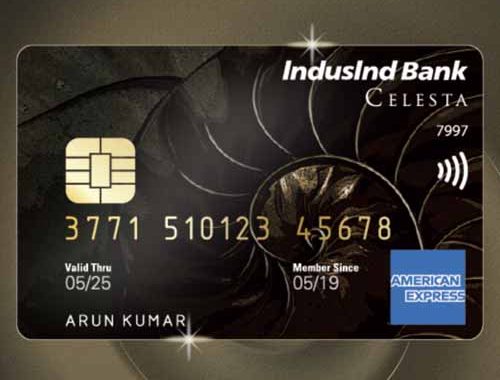

RBL Credit Credit Card Review: Documents Required, Types, Rewards  Induslnd Credit Credit Card Review: Documents Required, Types, Rewards

Induslnd Credit Credit Card Review: Documents Required, Types, Rewards